Navigating Oregon's probate process is often misunderstood and complex, leading to delays and legal complications. To avoid common probate issues, such as unclear asset distribution causing family disputes, estate planning is crucial. Proactive measures like seeking professional advice are essential for efficient will or trust document execution, ensuring wishes are accurately reflected.

“Unraveling Common Oregon Probate Mistakes: A Comprehensive Guide. Many Oregon residents face unforeseen challenges during the probate process due to a lack of understanding or preparation. This article sheds light on three prevalent issues: Misunderstanding the state’s unique probate procedures, failing to accurately name beneficiaries, and inadequate planning for asset distribution. Additionally, it highlights the critical aspects often overlooked, such as tax implications and compliance with estate planning requirements. By identifying these common pitfalls, individuals can navigate Oregon’s probate process with greater confidence.”

- Misunderstanding the Probate Process in Oregon

- Omitting or Incorrectly Naming Beneficiaries

- Insufficient Planning for Asset Distribution

- Ignoring Tax Implications and Estate Planning Requirements

Misunderstanding the Probate Process in Oregon

Many people assume that navigating the Oregon probate process will be straightforward, especially if they’ve heard it can take a long time in other states. However, this is often where common probate issues in Oregon begin. The reality is, probate is a complex legal procedure with many moving parts, and misunderstanding it can lead to significant delays or even legal complications.

One of the primary reasons for these problems is that probate laws vary from state to state, and what might be standard practice in one place could be quite different in Oregon. For instance, not understanding the requirements for filing documents, the process of distributing assets, or the rules around appointments can create significant obstacles. It’s crucial to educate yourself about these procedures early on to avoid common probate issues that could lengthen an already challenging time for your family.

Omitting or Incorrectly Naming Beneficiaries

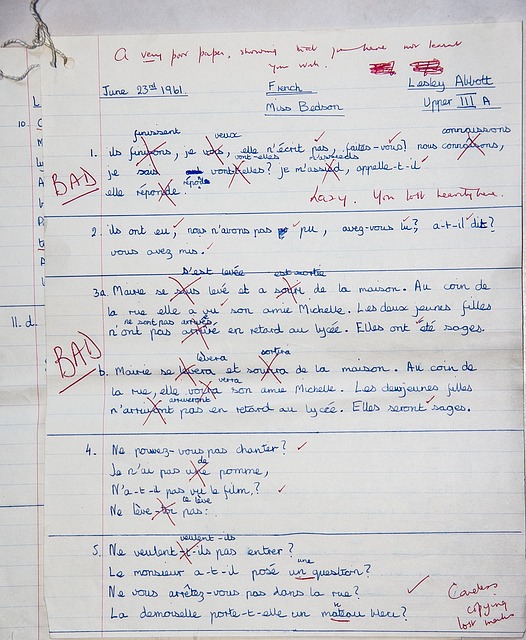

When preparing an Oregon probate, one of the most frequent mistakes is omitting or incorrectly naming beneficiaries. This can lead to significant legal and financial complications down the line. Every beneficiary, whether they are named in a will or a trust, must be clearly identified with their correct relationship to the decedent (the person who has passed away). Omission could result in these individuals being left out of the probate process entirely, while incorrect naming may cause confusion and delays as the court works to clarify the intended beneficiaries.

In the rush to finalize legal documents, it’s easy for mistakes like these to occur. However, their impact can be substantial. Beneficiaries who are omitted or misnamed could lose out on their rightful inheritance, leading to disputes among family members or even legal challenges. To avoid these common probate issues in Oregon, it’s crucial to take the time to double-check and verify all beneficiary information before submitting the documents for probate.

Insufficient Planning for Asset Distribution

Many people in Oregon overlook the importance of comprehensive estate planning, which can lead to significant common probate issues. Effective asset distribution is a key aspect that often gets overlooked during the planning phase. Without a clear and detailed will or trust document, it becomes challenging for the court to interpret an individual’s wishes regarding the division of their assets after their passing. This can result in lengthy legal battles among family members, ultimately prolonging the probate process and causing unnecessary stress.

Insufficient planning often means that assets may not be distributed according to the testator’s desires, potentially leading to disputes and even legal challenges. It is crucial for individuals to anticipate potential conflicts and take proactive measures to ensure their wishes are accurately reflected in their estate planning documents. By seeking professional advice, Oregonians can create a comprehensive strategy to navigate common probate issues efficiently and with greater peace of mind.

Ignoring Tax Implications and Estate Planning Requirements

Many people in Oregon overlook the tax implications and estate planning requirements when going through the probate process, which can lead to significant mistakes. Probate is a complex legal procedure that involves administering the estate of a deceased person. During this time, it’s crucial to consider not only the distribution of assets but also the potential tax liabilities associated with them. For example, transferring property or investments within an estate might trigger capital gains taxes that could have been avoided through proper planning.

Estate planning is an essential aspect often overlooked in probate matters. A well-crafted will and trust can help navigate common probate issues in Oregon by designating specific assets to beneficiaries and outlining how the estate should be managed. This proactive approach ensures a smoother process, minimizes legal fees, and helps protect the interests of all involved parties. Ignoring these considerations can result in delays, additional costs, and even potential disputes among heirs.