Oregon's probate laws demand meticulous adherence to avoid costly estate mistakes. Professionals need updated knowledge, analytical skills, and strong understanding of legislative changes to protect client interests. Common oversights include neglecting will updates and asset omissions, leading to delays, legal battles, and unintended consequences. Effective representation guides clients, minimizes conflicts from planning errors, and ensures accurate will reflection. Executors must manage assets responsibly, maintaining records, adhering to terms, and avoiding personal use to avoid common Oregon estate mistakes. Navigating probate complexities requires expert guidance from attorneys to ensure compliance, minimize risks, and facilitate a smoother process for beneficiaries.

In navigating Oregon’s probate process, understanding local laws and avoiding common pitfalls is crucial for effective representation. This article delves into key areas that can make or break estate planning efforts, including a thorough examination of Oregon’s probate laws and procedures. We highlight critical mistakes to steer clear of, such as asset mismanagement by executors, and offer strategies to mitigate risks. Additionally, we explore when seeking legal counsel is essential for navigating complexities in Oregon’s probate landscape, ensuring your clients’ interests are protected.

- Understanding Oregon's Probate Laws and Procedures

- Common Mistakes in Estate Planning and Their Impact

- Mismanaging Assets: Avoidance Strategies for Executors

- Navigating Complexities: When to Seek Legal Counsel

Understanding Oregon's Probate Laws and Procedures

Understanding Oregon’s probate laws and procedures is crucial for effective representation in an Oregon estate matter. The state has specific rules governing the administration of decedents’ estates, including will validation, asset distribution, and tax obligations. Familiarity with these regulations enables attorneys to navigate the process seamlessly, ensuring that all legal requirements are met.

Oregon probate mistakes can be costly and time-consuming for clients. Lawyers must stay updated on changes in legislation, understand complex estate planning concepts, and possess strong analytical skills to interpret and apply relevant laws. By doing so, they can protect their clients’ interests, avoid potential pitfalls, and achieve favorable outcomes in probate proceedings.

Common Mistakes in Estate Planning and Their Impact

Many individuals in Oregon underestimate the importance of meticulous planning when it comes to their estate. Common mistakes, such as failing to update wills regularly or neglecting to include all assets, can have significant repercussions. These oversights often lead to delays in the probate process and cause unnecessary stress for beneficiaries. For instance, an outdated will might disinherit intended heirs, leading to legal battles over the distribution of the estate.

Additionally, insufficient planning may result in high legal fees and complex tax issues. Complex estates require careful navigation through various laws and regulations, and a well-crafted plan can prevent costly mistakes. Effective Oregon estate representation involves guiding clients through these challenges, ensuring their wishes are accurately reflected, and minimizing potential conflicts that could arise from simple oversights during the initial planning stages.

Mismanaging Assets: Avoidance Strategies for Executors

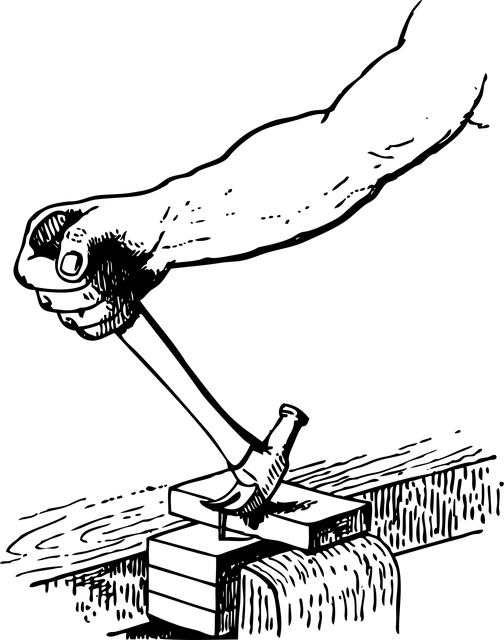

Mismanaging assets is one of the most common Oregon estate mistakes made by executors. This can occur when an executor fails to properly distribute property according to the will or trust, mixes personal and estate funds, or makes financial decisions that benefit themselves over the beneficiaries. To avoid these Oregon probate mistakes, executors should maintain meticulous records, ensure transparency in all transactions, and strictly adhere to the terms of the testament or trust document.

Implementing sound financial practices is crucial. This includes obtaining appraisals for significant assets, seeking legal counsel when necessary, and avoiding any personal use of estate funds. Regular communication with beneficiaries and an open book policy regarding finances can also help prevent missteps. Executors should treat the estate as a separate entity, prioritizing its management and distribution over personal gain.

Navigating Complexities: When to Seek Legal Counsel

Navigating the complexities of an Oregon probate can be a daunting task for many individuals, especially those dealing with an estate for the first time. It’s easy to make mistakes that could have significant legal and financial implications. Common Oregon estate mistakes include misinterpreting probate laws, failing to file necessary documents accurately, or omitting important information from the will. These errors can lead to delays, increased costs, and even disputes among beneficiaries.

When dealing with an intricate estate, it’s crucial to seek legal counsel from experienced Oregon probate attorneys. They possess the expertise to guide clients through the process, ensuring compliance with state laws and regulations. Legal professionals can also help minimize potential risks by providing strategic advice tailored to each client’s unique situation. This proactive approach allows for a smoother transition during what can be an emotionally charged time, ensuring that the wishes of the deceased are respected and carried out effectively.